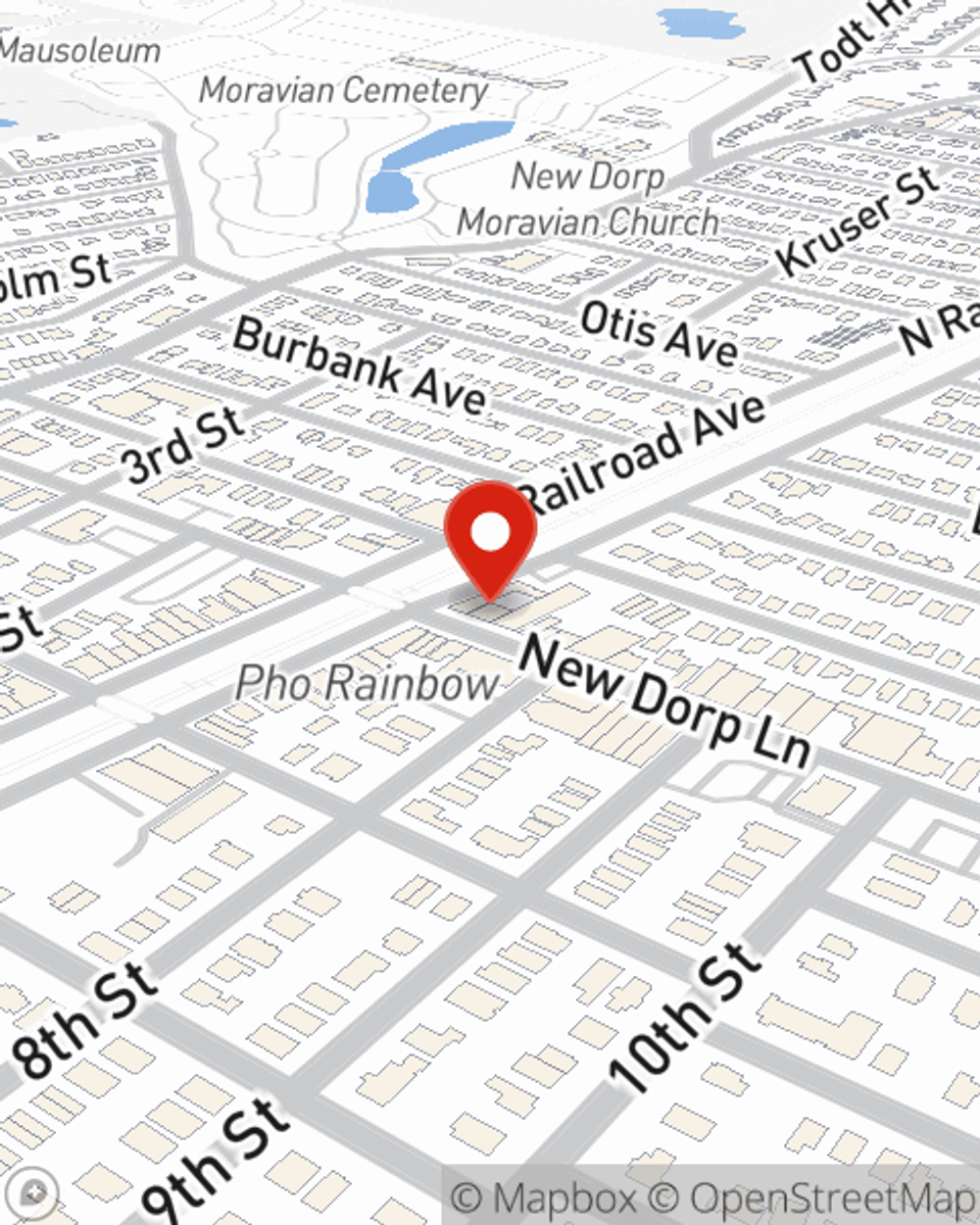

Business Insurance in and around Staten Island

Staten Island! Look no further for small business insurance.

No funny business here

Help Prepare Your Business For The Unexpected.

Small business owners like you wear a lot of hats. From tech support to social media manager, you do as much as possible each day to make your business a success. Are you a pharmacist, a physician or an optometrist? Do you own a music school, an auto parts shop or a dry cleaner? Whatever you do, State Farm may have small business insurance to cover it.

Staten Island! Look no further for small business insurance.

No funny business here

Small Business Insurance You Can Count On

When one is as committed to their small business as you are, it makes sense to want to make sure everything is in order. That's why State Farm has coverage options for commercial auto, artisan and service contractors, worker’s compensation, and more.

Since 1935, State Farm has helped small businesses manage risk. Visit agent Larissa Buerano's team to review the options specifically available to you!

Simple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Larissa Buerano

State Farm® Insurance AgentSimple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?